Finances are one of those areas that most of us don’t like delving into, but is absolutely necessary if we are ever going to increases that rainy day fund.

Finances are one of those areas that most of us don’t like delving into, but is absolutely necessary if we are ever going to increases that rainy day fund.

It’s hard to pinpoint how much we should be spending on the monthly budget. It can be a challenge to even say what you are spending now.

When it comes to food, people, and the Western world specifically, have a blind spot when it comes to grocery shopping and eating out.

It may be hard to justify buying those new shoes you wanted, but you don’t think twice when deciding to order takeout after a long day; both indubitably a hit on the bank account.

If you have a budget, and stick to it every month, let’s see how you stack up against some of experts in the field.

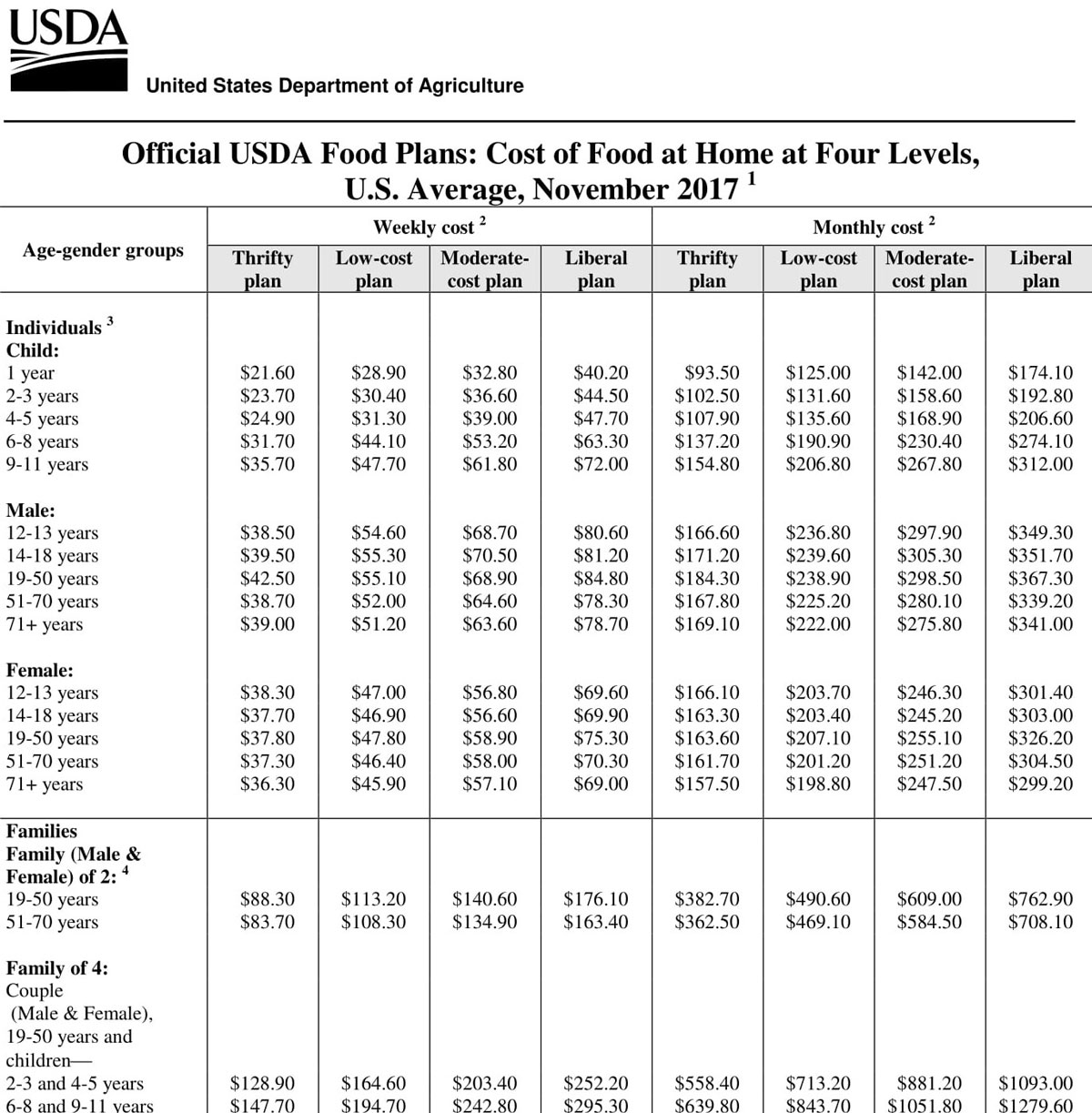

The most comprehensive and up to date food chart available would be the monthly allocations put out by the USDA.

This chart gives 4 categories to encompass all types of consumers; whether you’re a penny pincher or don’t think twice before throwing what you want in the cart, they have the budget for you.

Find which spending column works for your budget and try to stay on task while shopping.

USA Today gave an example of their layout:

“For example, let’s say you are a family of four. Your kids are a 12-year-old boy and an 8-year-old girl. You decide to try to live on a low-cost plan. According to the report, the total monthly amount for your son will be $236.30 and for your daughter $190.10. Dad’s monthly amount is $238.30 and mom’s is $206.30. That makes the grand total grocery budget $871.00 per month or $217.75 per week.”

You may be shocked when you see what the budget is for your family size. You could be pleasantly surprised or unpleasantly surprised.

There are a few things to consider when aiming for the high or low end of the budget spectrum.

Being a family of four with two teenage boys will be drastically different than feeding a family of four with two picky little ones.

Also, living in a metropolitan region will give rise to higher food cost than living in a small urban or rural area.

USA Today reported on how much you should be spending on food for your family using a percentage of your income:

“According to the U.S. Department of Agriculture, Americans spend, on average, around 6% of their budget on food. However, the study also shows that they also spend 5% of their disposable income on dining out. That makes your food budget 11% of your overall income.

If you use this method, budget 6% for groceries each month and 5% for dining out. If your take-home income is $3,000 a month, you will budget around $180 for groceries and $150 for dining out. Of course, if $180 won’t cover your needs, you should cut back on dining out and use any additional money towards your grocery needs.”

There is not a hard line right or wrong when it comes to grocery habits, unless it’s putting you out on the street.

Setting up a budget paves the way for financial stability. That is something we all strive for. It is important to note that even more than having a budget, is actually abiding by one.

To find out where you are currently, to see where changes would make sense financially, complete a spending form.

A spending form accounts for where all of your money goes in a month, this includes entertainment and incidentals.

Once that is evaluated adjust your grocery bill accordingly. That may mean that you won’t get to buy everyone’s favorite box of cereal each week, or it may just mean limiting your daily coffee shop run.

Someone in your family, or yourself, may have a specific dietary preference or restriction. You need to account for your grocery bill being a little inflated if this is the case.

If specialty items run considerably high, try adjusting your entertainment budget to account for that; especially if it’s necessary to one’s health, like allergies.

Find a budget that works for you. There are several ways to reduce a grocery bill if necessary as well.

You can cut coupons, find digital coupons, apply for a cash back credit card that you pay back in full each grocery visit, buy the grocery store brand of items, and cut back on snack foods.

Budgeting may not be your cup of tea, but with a few conscious trips to the store, you will be a pro in no time.

Please let us know in the comments section if have used one of the budgets we listed and how it worked for you, or if you have a tip that can help others get on track.